In August, we provided an overview of the recent increase in regulatory and private litigation activity around per- and polyfluoroalkyl substances (PFAS), colloquially known as “forever chemicals,” and potential insurance coverage for PFAS liability. There have been important developments on the PFAS front in the past few months. Companies with any connection to PFAS need to be cognizant of the evolving regulatory landscape and be prepared to defend against potential PFAS liability. Fortunately, insurance coverage may be available to help mitigate these fast-growing claims—including coverage under historic general liability policies.

In August, we provided an overview of the recent increase in regulatory and private litigation activity around per- and polyfluoroalkyl substances (PFAS), colloquially known as “forever chemicals,” and potential insurance coverage for PFAS liability. There have been important developments on the PFAS front in the past few months. Companies with any connection to PFAS need to be cognizant of the evolving regulatory landscape and be prepared to defend against potential PFAS liability. Fortunately, insurance coverage may be available to help mitigate these fast-growing claims—including coverage under historic general liability policies.

Articles Tagged with PFAS

PFAS Enforcement and Liability Is on the Rise—Insurance Can Help

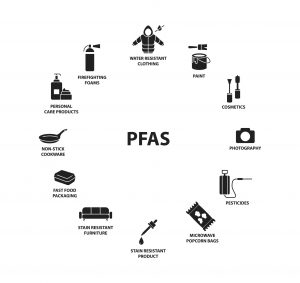

A key component of a company’s risk management function is to keep a close eye on new and developing sources of liability and to put in place appropriate insurance to respond in the event those liabilities ripen. In recent years, there has been a significant increase in legal and regulatory attention on per- and polyfluoroalkyl substances, more commonly known as “PFAS” or “forever chemicals.” PFAS are used in countless applications, and many companies across the country bear potential liability, from chemical companies to manufacturers to retailers to corporate end users. PFAS-related enforcement is focused on remedying impacts to both the environment and human health. Importantly, a company’s liability for PFAS-related contamination or bodily injury may be covered under historic general liability policies and/or modern-day pollution liability policies. As regulation and litigation relating to these ubiquitous substances continues to surge, corporate policyholders with potential exposure should be proactive to examine their insurance portfolios and position themselves for potential insurance coverage in the event they become a PFAS liability target.

A key component of a company’s risk management function is to keep a close eye on new and developing sources of liability and to put in place appropriate insurance to respond in the event those liabilities ripen. In recent years, there has been a significant increase in legal and regulatory attention on per- and polyfluoroalkyl substances, more commonly known as “PFAS” or “forever chemicals.” PFAS are used in countless applications, and many companies across the country bear potential liability, from chemical companies to manufacturers to retailers to corporate end users. PFAS-related enforcement is focused on remedying impacts to both the environment and human health. Importantly, a company’s liability for PFAS-related contamination or bodily injury may be covered under historic general liability policies and/or modern-day pollution liability policies. As regulation and litigation relating to these ubiquitous substances continues to surge, corporate policyholders with potential exposure should be proactive to examine their insurance portfolios and position themselves for potential insurance coverage in the event they become a PFAS liability target.

Policyholder Pulse

Policyholder Pulse