Last month, we discussed a decision by the Northern District of Illinois finding an amount labeled “restitution” in a settlement between a pharmaceutical company and the DOJ was insurable loss under a D&O policy. Shortly after that post, the New York Court of Appeals reached a similar conclusion, continuing the trend of looking beyond the labels used for the payments in the underlying settlement agreement. In rejecting the insurers’ argument, the court evaluated the purpose of the payments and the nature of how they were derived to find the payments at issue were insurable under a Professional Liability policy, despite being called “disgorgement.”

Last month, we discussed a decision by the Northern District of Illinois finding an amount labeled “restitution” in a settlement between a pharmaceutical company and the DOJ was insurable loss under a D&O policy. Shortly after that post, the New York Court of Appeals reached a similar conclusion, continuing the trend of looking beyond the labels used for the payments in the underlying settlement agreement. In rejecting the insurers’ argument, the court evaluated the purpose of the payments and the nature of how they were derived to find the payments at issue were insurable under a Professional Liability policy, despite being called “disgorgement.”

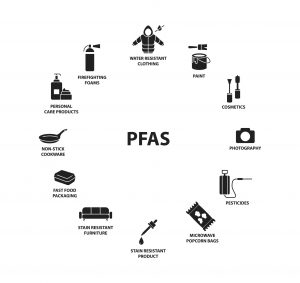

An Update on Recent PFAS Regulation and Enforcement and the Resulting Insurance Implications

In August, we provided an overview of the recent increase in regulatory and private litigation activity around per- and polyfluoroalkyl substances (PFAS), colloquially known as “forever chemicals,” and potential insurance coverage for PFAS liability. There have been important developments on the PFAS front in the past few months. Companies with any connection to PFAS need to be cognizant of the evolving regulatory landscape and be prepared to defend against potential PFAS liability. Fortunately, insurance coverage may be available to help mitigate these fast-growing claims—including coverage under historic general liability policies.

In August, we provided an overview of the recent increase in regulatory and private litigation activity around per- and polyfluoroalkyl substances (PFAS), colloquially known as “forever chemicals,” and potential insurance coverage for PFAS liability. There have been important developments on the PFAS front in the past few months. Companies with any connection to PFAS need to be cognizant of the evolving regulatory landscape and be prepared to defend against potential PFAS liability. Fortunately, insurance coverage may be available to help mitigate these fast-growing claims—including coverage under historic general liability policies.

The Benefits of Mediating Complex Insurance Claims in a Post-Pandemic World

In my December 18, 2017, blog post, I wrote about “choosing the right path” to settle complex insurance claims and emphasized the benefits of private structured negotiation, a type of negotiation undertaken without the assistance of mediators. At that time, I identified mediation as “a good potential next step.” Since 2017, the world has suffered through a pandemic, and it has become apparent to me that private settlement discussions can sometimes become discoverable in litigation, even if compromise communications are not permitted in evidence. In the wake of these developments, what I previously counseled as a good potential second step is now in my view the proper first step in most cases. Notwithstanding, while mediation has many benefits, its efficacy depends on identifying the right mediator, selecting the right timing and format (now, likely virtual), and making sure that any settlement reached in mediation does not later unravel.

In Another Blow to the “Uninsurability” Defense, Court Holds that Settlement Labeled “Restitution” Is Insurable

In previous posts, we have emphasized the continued judicial trend rejecting insurer arguments that losses purportedly sounding in restitution or disgorgement are “uninsurable” under D&O policies. Despite that trend, insurers continue to invoke “uninsurability” under state law or vague notions of public policy, even where such a doctrine has not been recognized in the relevant jurisdiction.

In previous posts, we have emphasized the continued judicial trend rejecting insurer arguments that losses purportedly sounding in restitution or disgorgement are “uninsurable” under D&O policies. Despite that trend, insurers continue to invoke “uninsurability” under state law or vague notions of public policy, even where such a doctrine has not been recognized in the relevant jurisdiction.

Biometric Privacy, BIPA and the Battle for EPLI Policy Coverage

Do employees have a privacy right in the shape of their faces, the color of their eyes, or the texture of their fingertips? In many states, the law now says yes—leading employers to ask: Are resulting biometric privacy claims covered under their existing policies, or is insurance otherwise available?

Do employees have a privacy right in the shape of their faces, the color of their eyes, or the texture of their fingertips? In many states, the law now says yes—leading employers to ask: Are resulting biometric privacy claims covered under their existing policies, or is insurance otherwise available?

Federal Court Holds Allegations of Coronavirus on Premises Sufficiently Allege Physical Loss of or Damage to Property

Judge Catherine C. Eagles of the U.S. District Court for the Middle District of North Carolina made the right call by allowing a large hospital system policyholder to litigate the merits of its COVID-19 business interruption claim to recovery where so many others have had that door improperly and prematurely shut by other federal courts recently.

Flooded by Ida? Many Policyholders Can Expect Increased Premiums for Flood Insurance

After hitting the shores of Louisiana with winds of up to 172mph in late August, Hurricane Ida’s remnants barreled up to the northeastern United States, leaving waves of destruction in its wake. The deluge of rain—more than half-a-foot fell in just a few hours—turned streets and subway platforms into rivers. The catastrophic flooding caused by the record-breaking rainfall killed several dozen people, left thousands without power, and damaged countless homes and businesses. All told, Ida is said to have caused more than $50 billion in damage. And scientists predict that, because of climate change, heavy rainfall-producing storms like Ida will only become more and more frequent.

After hitting the shores of Louisiana with winds of up to 172mph in late August, Hurricane Ida’s remnants barreled up to the northeastern United States, leaving waves of destruction in its wake. The deluge of rain—more than half-a-foot fell in just a few hours—turned streets and subway platforms into rivers. The catastrophic flooding caused by the record-breaking rainfall killed several dozen people, left thousands without power, and damaged countless homes and businesses. All told, Ida is said to have caused more than $50 billion in damage. And scientists predict that, because of climate change, heavy rainfall-producing storms like Ida will only become more and more frequent.

Couch’s “Physical Alteration” Fallacy: Its Origins and Consequences

Look at virtually any COVID-19 case favoring an insurer, and you will find a citation to Section 148:46 of Couch on Insurance. It is virtually ubiquitous: courts siding with insurers cite Couch as restating a “widely held rule” on the meaning of “physical loss or damage”—words typically in the trigger for property-insurance coverage, including business-income coverage. It has been cited, ad nauseam, as evidence of a general consensus that all property-insurance claims require some “distinct, demonstrable, physical alteration of the property.” Indeed, some pro-insurer decisions substitute a citation to this section for an actual analysis of the specific language before the court.

In a new article in the Tort, Trial & Insurance Practice Law Journal, colleague Scott Greenspan and co-authors address the history and development of the “physical loss” rule, Couch’s distortion of it, and its impact on contemporary litigation. They also explore the correct rule, as explained in pre-and post-Couch precedent and in other treatises that more accurately state the law. Finally, the authors articulate the severe consequences that will follow for policyholders—banks, businesses, and homeowners—if Couch’s rule, continues to be blindly followed by courts without knowledge of its origins in legal quicksand.

Your CGL Policy May Provide Coverage for a Data Breach

As cybercrimes and data breaches continue to cause significant damage to companies of all types, policyholders are looking to their various insurance policies for coverage to help weather the storm and recoup losses. A recent decision by the U.S. Court of Appeals for the Fifth Circuit highlights the need for companies to review all of their policies for potential cyber-related coverage, including their CGL policies.

As cybercrimes and data breaches continue to cause significant damage to companies of all types, policyholders are looking to their various insurance policies for coverage to help weather the storm and recoup losses. A recent decision by the U.S. Court of Appeals for the Fifth Circuit highlights the need for companies to review all of their policies for potential cyber-related coverage, including their CGL policies.

PFAS Enforcement and Liability Is on the Rise—Insurance Can Help

A key component of a company’s risk management function is to keep a close eye on new and developing sources of liability and to put in place appropriate insurance to respond in the event those liabilities ripen. In recent years, there has been a significant increase in legal and regulatory attention on per- and polyfluoroalkyl substances, more commonly known as “PFAS” or “forever chemicals.” PFAS are used in countless applications, and many companies across the country bear potential liability, from chemical companies to manufacturers to retailers to corporate end users. PFAS-related enforcement is focused on remedying impacts to both the environment and human health. Importantly, a company’s liability for PFAS-related contamination or bodily injury may be covered under historic general liability policies and/or modern-day pollution liability policies. As regulation and litigation relating to these ubiquitous substances continues to surge, corporate policyholders with potential exposure should be proactive to examine their insurance portfolios and position themselves for potential insurance coverage in the event they become a PFAS liability target.

A key component of a company’s risk management function is to keep a close eye on new and developing sources of liability and to put in place appropriate insurance to respond in the event those liabilities ripen. In recent years, there has been a significant increase in legal and regulatory attention on per- and polyfluoroalkyl substances, more commonly known as “PFAS” or “forever chemicals.” PFAS are used in countless applications, and many companies across the country bear potential liability, from chemical companies to manufacturers to retailers to corporate end users. PFAS-related enforcement is focused on remedying impacts to both the environment and human health. Importantly, a company’s liability for PFAS-related contamination or bodily injury may be covered under historic general liability policies and/or modern-day pollution liability policies. As regulation and litigation relating to these ubiquitous substances continues to surge, corporate policyholders with potential exposure should be proactive to examine their insurance portfolios and position themselves for potential insurance coverage in the event they become a PFAS liability target.