The annual Pillsbury Insurance Policyholder Summit is once again approaching!

Taking place on October 28, this signature event will occur simultaneously in our New York, Houston and San Francisco offices, with live collaboration between locations.

The Summit brings together industry leaders and risk management professionals to explore today’s most pressing insurance challenges and opportunities. This year’s program will highlight emerging risks and evolving issues, including AI risk developments, trends in environmental liability and transactional risk insurance, construction coverage for data centers and infrastructure, and managing complex/mass tort claims.

For more information or to register, please contact Tricia Larade.

Policyholder Pulse

Policyholder Pulse

The Illinois Supreme Court has teed up a significant insurance question: Does a standard pollution exclusion bar coverage when the alleged “pollution” was not considered to be pollution when the policy issued—where the substance was lawfully emitted under an environmental permit?

The Illinois Supreme Court has teed up a significant insurance question: Does a standard pollution exclusion bar coverage when the alleged “pollution” was not considered to be pollution when the policy issued—where the substance was lawfully emitted under an environmental permit? In what was likely a shock to coal-fired electric utilities, the U.S. Court of Appeals for the District of Columbia Circuit held on June 28, 2024, that proposed decisions by the U.S. Environmental Protection Agency in January 2022—prohibiting coal-fired power plants from closing coal ash impoundments where coal ash is in contact with groundwater—were a “straightforward application” of a previously promulgated agency rule. In

In what was likely a shock to coal-fired electric utilities, the U.S. Court of Appeals for the District of Columbia Circuit held on June 28, 2024, that proposed decisions by the U.S. Environmental Protection Agency in January 2022—prohibiting coal-fired power plants from closing coal ash impoundments where coal ash is in contact with groundwater—were a “straightforward application” of a previously promulgated agency rule. In  Temperatures in Arizona this week reached

Temperatures in Arizona this week reached  Early in 2021, we wrote about potential insurance implications that could arise from the then-new

Early in 2021, we wrote about potential insurance implications that could arise from the then-new  In August, we provided an

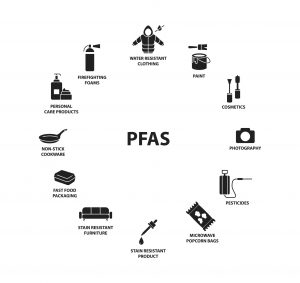

In August, we provided an  A key component of a company’s risk management function is to keep a close eye on new and developing sources of liability and to put in place appropriate insurance to respond in the event those liabilities ripen. In recent years, there has been a significant increase in legal and regulatory attention on per- and polyfluoroalkyl substances, more commonly known as “PFAS” or “forever chemicals.” PFAS are used in countless applications, and many companies across the country bear potential liability, from chemical companies to manufacturers to retailers to corporate end users. PFAS-related enforcement is focused on remedying impacts to both the environment and human health. Importantly, a company’s liability for PFAS-related contamination or bodily injury may be covered under historic general liability policies and/or modern-day pollution liability policies. As regulation and litigation relating to these ubiquitous substances continues to surge, corporate policyholders with potential exposure should be proactive to examine their insurance portfolios and position themselves for potential insurance coverage in the event they become a PFAS liability target.

A key component of a company’s risk management function is to keep a close eye on new and developing sources of liability and to put in place appropriate insurance to respond in the event those liabilities ripen. In recent years, there has been a significant increase in legal and regulatory attention on per- and polyfluoroalkyl substances, more commonly known as “PFAS” or “forever chemicals.” PFAS are used in countless applications, and many companies across the country bear potential liability, from chemical companies to manufacturers to retailers to corporate end users. PFAS-related enforcement is focused on remedying impacts to both the environment and human health. Importantly, a company’s liability for PFAS-related contamination or bodily injury may be covered under historic general liability policies and/or modern-day pollution liability policies. As regulation and litigation relating to these ubiquitous substances continues to surge, corporate policyholders with potential exposure should be proactive to examine their insurance portfolios and position themselves for potential insurance coverage in the event they become a PFAS liability target.